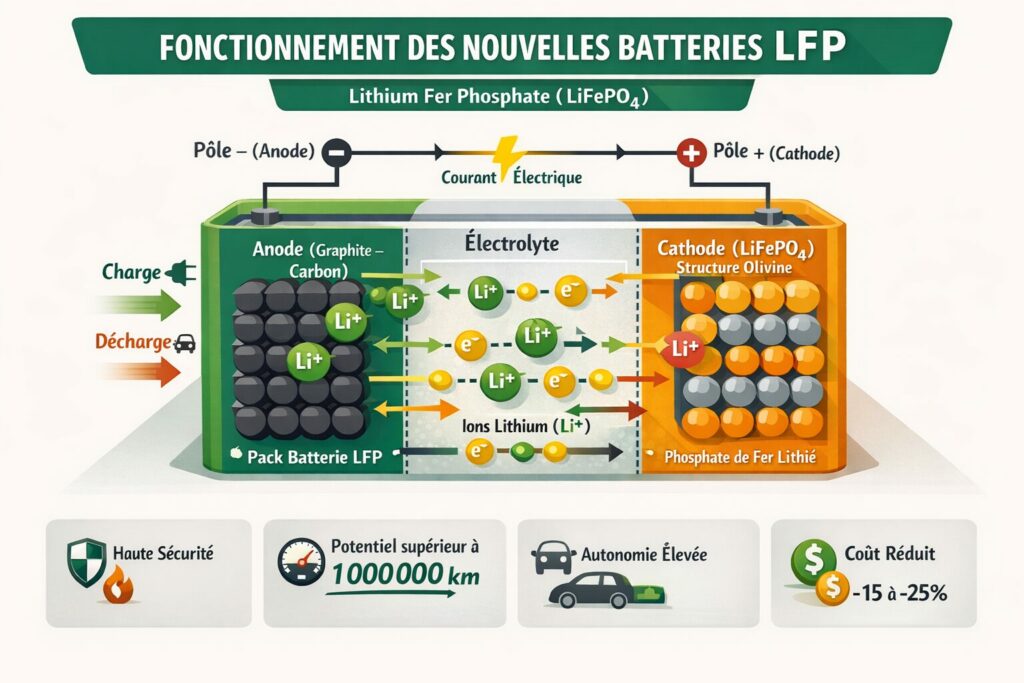

Cheaper, longer-lasting and now more efficient, new-generation LFP batteries are slowly but surely emerging as a key solution for bringing down the price of electric vehicles in Europe. Behind this chemistry, long confined to the entry-level range, lies a major industrial, economic and strategic shift for European carmakers.

Price, the Achilles heel of electric vehicles

For more than a decade, the democratisation of the electric vehicle has come up against a simple but complex reality. The battery remains its most expensive component. In Europe, it still accounts for 30-35% of the total cost of a vehicle, an economic burden that limits access to electric models for a large proportion of motorists. Despite public subsidies, the entry ticket is still high, particularly when compared with combustion vehicles, which are still cheaper to buy.

Against this backdrop, every technological development capable of lowering the cost per kWh is closely scrutinised by the industry. And over the last two years, one chemistry has come back to the fore with unexpected force: Lithium Iron Phosphate (or LFP). Long perceived as less efficient, LFPs have undergone profound changes: today, their production cost is around 15 to 25% lower than NMC (nickel, manganese, cobalt) chemistries, with an average price of between 90 and 100 dollars per kWh, compared with 110 to 130 dollars for traditional batteries. On an industrial scale, this difference makes all the difference.

Long underestimated, now at the heart of the game

LFP batteries have long been shunned in Europe, primarily because of their lower energy density. Less compact, they offered a more limited range, a criterion considered to be a redhibitory factor in a market still obsessed by the number of kilometres travelled. But this structural weakness is now being overcome. The latest generations of LFPs now exceed 200 Wh/kg, a threshold that makes them fully competitive for entry-level and mid-range vehicles. Industrial innovations such as Cell-to-Pack and Cell-to-Chassis reduce unnecessary structural elements, optimising the integration of the battery in the vehicle.

The results are tangible: some platforms now achieve theoretical ranges of over 700 km in the WLTP cycle, as with CATL’s Shenxing Pro technology, while retaining the historic advantages of LFP. Increased safety, high thermal stability and much slower degradation over time. Where an NMC battery sees its performance drop progressively, an LFP can withstand up to 12,000 charge cycles and aim for a lifespan of 20 years or almost a million kilometres. A decisive argument for fleets, heavy-duty private users, and also for the second-hand electric vehicle market.

Immediate savings for everyone

The economic impact of this transition is major. On a vehicle sold for between €25,000 and €35,000, switching to an LFP battery would save an estimated €2,000 to €4,000 per unit. This margin can be reinvested in equipment, range… or simply passed on to the final price. This is precisely the lever that European carmakers are now seeking to activate, faced with double pressure.

On the one hand, price-conscious consumers. On the other, aggressive Chinese competition, able to offer low-cost electric vehicles thanks to complete control of the battery chain. LFPs also respond to a more realistic use of electric cars. They are better able to withstand 100% loads, reduce the risk of premature deterioration and simplify the day-to-day user experience. A seemingly minor detail, but a key factor in overcoming the reluctance of drivers who are still hesitant.

Industrial adoption accelerating in Europe

The European market for LFP batteries is currently growing rapidly. Estimated at just over 2 billion dollars in 2024, it could exceed 4.3 billion by 2029, with an annual growth rate of over 14%. This rise in power is automatically driving down costs, with packages now flirting with the symbolic 100 dollars per kWh mark.

Renault’s subsidiary Ampere has opted for controlled industrial integration, assembling packs in Douai, France, from cells supplied by LG and CATL. Stellantis, for its part, is going one step further by teaming up directly with CATL to build an LFP gigafactory in Spain, in which it has an equal stake. CATL is also stepping up its industrial presence on the continent, with plants in Germany, Hungary and soon in Spain, giving this chemistry a long-term foothold in Europe.

Industrial sovereignty: a still fragile balance

A central concern remains Europe’s dependence on Asian players. Today, almost 99% of LFP batteries are produced by Chinese companies, an imbalance that raises obvious geopolitical issues. The recent bankruptcy of Northvolt, a European player historically focused on NMC batteries, was a reminder of the fragility of the local ecosystem.

But Europe is not giving up. Local production strategies, industrial partnerships and investment in R&D are on the increase. The aim is clear: to secure supplies, control costs and build a credible European battery industry capable of meeting the continent’s environmental, social and industrial requirements.

The LFP as a strategic pivot for the EV

In the short and medium term, LFP batteries appear to be the strategic pivot for achieving a goal long thought to be out of reach: a reliable, long-lasting European electric car selling for around €25,000. Without this chemistry, the price battle against low-cost imports would remain largely unbalanced. By reconciling cost, safety, longevity and sufficient performance, LFPs are not completely replacing NMC batteries, but they are redefining the core of the market.

For the European automotive industry, the message is clear: the electric transition will not be won solely on the basis of maximum range or power, but on the ability to offer vehicles that are accessible, locally produced and technologically sober. And in this area, new-generation LFP batteries are becoming a decisive asset.

Sources: www.connaissancedesenergies.org – www.mordorintelligence.com – battery-tech.net