Faced with the boom in electric cars, China is stepping up its regulation. After autonomous driving and door handles, it’s now the turn of batteries to come under strict control. The famous « semi-solid batteries » will now have to bear the more precise name of « solid-liquid batteries ».

For years, the Chinese electric car market was very chaotic. Brands multiplied their promotions and exaggerated their announcements. Now Beijing wants to clarify things. The rules already cover battery safety, semi-autonomous driving and car design. Battery names must now also be precise.

The intermediate solution

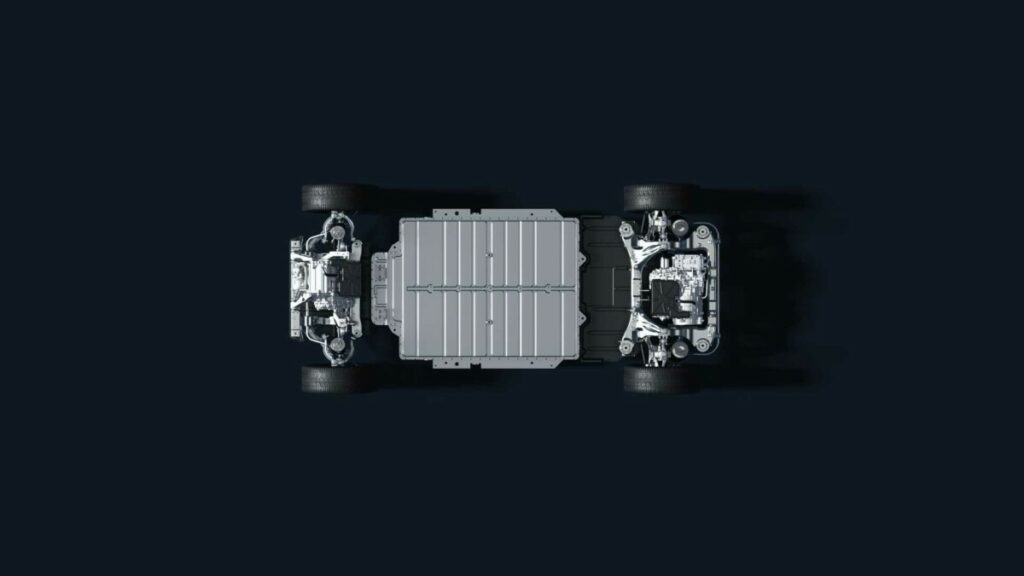

Solid batteries are seen as the Holy Grail of electromobility. They offer greater range, greater safety and rapid recharging, while being lighter. However, large-scale production is not expected until the end of the decade, although prototypes will be appearing as early as 2027. In the meantime, semi-solid batteries serve as an intermediate solution. Their partially solid electrolyte improves energy density and safety, while remaining simpler to manufacture than a totally solid battery.

Nio was a pioneer with a 150 kWh battery, offering more than 1,000 km of real range, although the manufacturer relativised this figure. MG then integrated the technology into its MG4 model, making the semi-solid battery accessible to mainstream vehicles. These examples show that this is a promising technology, but one that is still in transition.

A change of name

The Chinese regulator considers the term « semi-solid » to be ambiguous. Many consumers might believe that this is an almost finished version of solid batteries. To clear up this confusion, Beijing is now imposing the term « solid-liquid ». This term better reflects the actual chemistry: a partially solid electrolyte, but still liquid, reminding us that the real revolution is yet to come.

The solid state battery is at the heart of intense international competition. China, Japan, Korea and Europe are battling to produce the most efficient technology. Chinese carmakers are aiming for limited production by 2027 and mass deployment by 2030. This technological race illustrates the strategic importance of batteries for the future of the car.

In the meantime, semi-solid batteries are playing a key role. They offer long autonomy, rapid recharging and improved safety. What’s more, they can be integrated into existing production lines, limiting industrial costs. These technologies represent a stepping stone to the widespread use of solid batteries.

Towards a structured market

In the long term, the battery market should segment into three major families. Top-of-the-range solid batteries for premium vehicles, intermediate LFP or LMFP batteries for a good cost/performance compromise, and sodium-ion batteries for economical urban vehicles. Each technology stands out for its autonomy, safety and production price, while offering rapid recharging.

Chinese regulation illustrates the country’s desire to stabilise a rapidly expanding market. By imposing precise names and controlling manufacturers’ communications, Beijing is seeking to protect consumers and structure innovation. Solid-liquid batteries represent a key stage in the energy transition, paving the way for the real solid batteries that will transform the automotive industry in the next ten years.