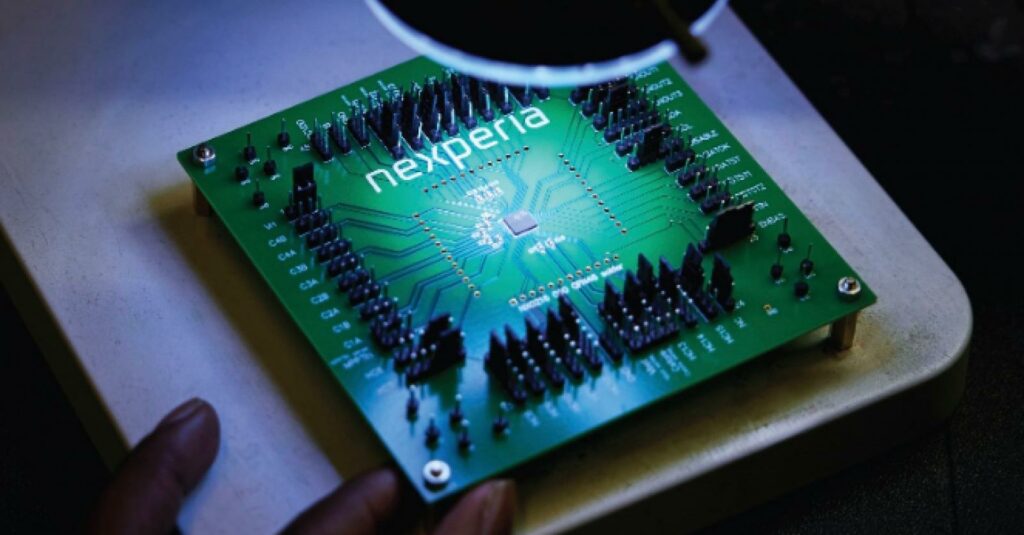

A new storm is shaking up the European automotive industry. The Dutch semiconductor company Nexperia is caught up in a geopolitical conflict between Beijing and Washington. The situation threatens to paralyse production lines, with worrying consequences for manufacturers and their suppliers.

The complex history of Nexperia

Nexperia ‘s story began in 2017, when Chinese company Jianguang Asset Management bought the former Philips subsidiary for $2.7 billion. In 2019, the company was sold to Wingtech for $3.7 billion. Located in Nijmegen, near the German border, Nexperia manufactures diodes and transistors that are essential to the automotive industry. Although discreet, these components are strategic to the smooth running of modern vehicles.

American pressure on Nexperia

The Covid-19 pandemic highlighted the fragility of supply chains, making semiconductors strategic assets. In 2022, London blocked Nexperia’s takeover of Newport Wafer Fab, citing national security concerns. In December 2024, Washington placed Wingtech on its blacklist. The message sent to the Dutch was unambiguous: to maintain European production, Chinese manager Zhang Xuezheng had to leave the company. This demand was confirmed by an official document from the court in The Hague in June 2025.

Beijing’s response

Under American pressure, the Netherlands activated a 1952 law on the availability of assets to place Nexperia under trusteeship. Zhang Xuezheng was dismissed, provoking anger in Beijing, which described the decision as « economic banditry ». On 14 October, China blocked exports from Wingtech, a factory accounting for 70% of Nexperia’s final assembly capacity. Deprived of these components, the company suspended deliveries to Europe, jeopardising car production on the continent.

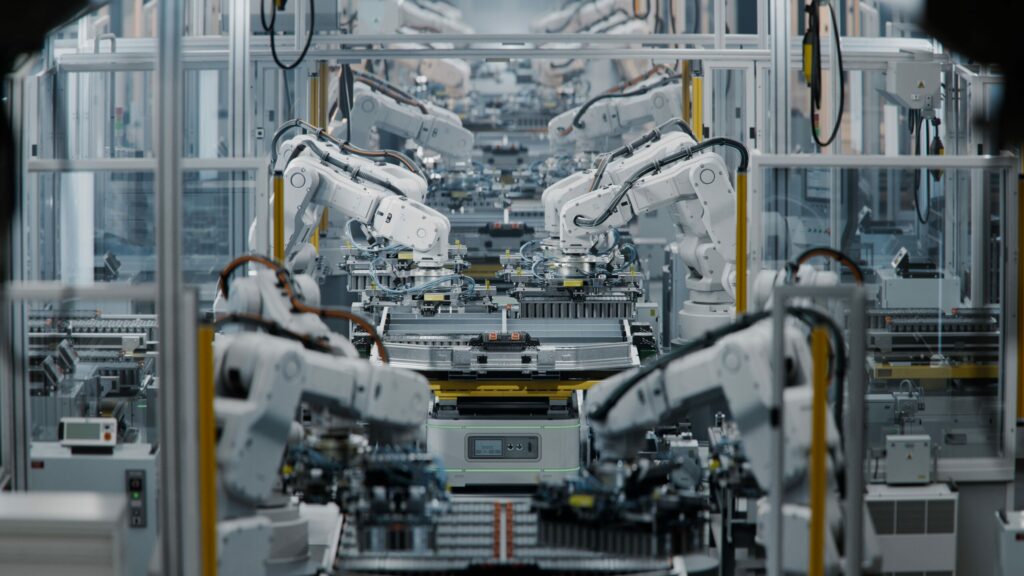

A threat to European car production

European Trade Commissioner Maros Sefcovic says he is willing to facilitate dialogue between the parties to preserve the stability of global supply chains. Sigrid de Vries, Director of the European Automobile Manufacturers Association, describes the situation as « alarming ». The certification of alternative products will take several months, risking major production delays. Hildegard Müller, President of the German Automobile Federation, warns that the crisis could lead to significant production stoppages.

Europe’s automotive giants under pressure

Volkswagen is already planning disruptions at its historic Wolfsburg site, which will affect production of the Golf and Tiguan models. According to Deutsche Bank analysts, German car production could fall by 10%, or even 30% in the worst-case scenario. Stellantis and Renault, interviewed by Le Point, say they are monitoring the situation closely, setting up monitoring units and keeping in daily contact with their suppliers to limit the impact. Memories of the historic shortage of semi-conductors between 2021 and 2023 are still fresh, and manufacturers are hoping to avoid a new industrial chaos.

German machine tools under pressure

After the automotive industry, the machine tool industry is starting to sound the alarm. Thilo Brückner, representative of the VDMA federation, toldAFP that motorised equipment ranging from generators to agricultural machinery could quickly suffer from a shortage of electronic components. The German Ministry of the Economy has brought together the main players to assess the impact, and has also mobilised the Chancellery to coordinate a response to this growing risk.

Geopolitical tensions and blocked flows

The situation has escalated since The Hague applied an old Cold War law to regain control of Nexperia. The company assembles its chips in Hamburg, then sends them to China for processing. Beijing now bans their re-export to Europe. Car manufacturers, the main consumers of Nexperia chips, fear production stoppages in the short term. Volkswagen, for example, cannot rule out interruptions in the coming weeks.

Potential consequences and industrial issues

Nexperia semiconductors account for more than 40% of the electronic components used by the European automotive industry. If the dispute continues, there could be more production stoppages. Volvo in Sweden, Volkswagen and other manufacturers in Germany are already planning adjustments or short-time working. Equipment manufacturers are putting in place monitoring and substitution mechanisms, but solutions remain limited in the short term.

A race against time

The European and German authorities are seeking to defuse the conflict. The Dutch Prime Minister, Dick Schoof, insists that the takeover of Nexperia is not aimed at China, but at correcting internal mismanagement. Despite these assurances, Beijing is maintaining its restrictions, forcing European manufacturers to find alternatives quickly. The automotive and machine tool industries are racing against time to secure their supply chains and avoid another crisis.