In the space of just three years, however, the country has undergone a spectacular transformation. Buoyed by the emergence of its national manufacturer Togg, an extremely attractive tax system and the offensive by foreign brands, led by the US and China, Turkey is now one of the most dynamic markets on the continent.

Spectacular take-off in 2025

Turkey is experiencing impressive growth this year. In fact, while several European countries are seeing sales of electric vehicles stagnate or fall back, Turkey is breaking all the records.

Indeed, the figures speak for themselves: according to data from the Association of Automobile Distributors (ODMD), in the first eleven months of 2025, the country recorded 166,665 sales of 100% electric vehicles, more than double the figure for the same period in 2024. At this rate, Turkey is poised to end the year with an increase in sales of more than 100% in one year.

If we broaden the spectrum to electrified vehicles as a whole, the shift is even more striking. Plug-in hybrids rose by more than 658% to 42,857 units over eleven months, while conventional hybrids sold more than 252,000 units. As a result, by January-November 2025, electrified vehicles (BEV + PHEV + HEV) accounted for around 45% of total registrations, compared with less than 25% the previous year.

Togg, Tesla, BYD: a trio that dominates the market

Behind these figures, which symbolise effective progress, three brands share almost the entire 100% electric market, with radically different strategies and profiles.

The winner is Togg, Turkey’s national manufacturer. It topped the podium with 31,715 units sold over eleven months. This figure marks a symbolic turning point: for the first time, a Turkish car brand is the leader in a strategic segment. Launched in 2023 with the T10X SUV, Togg benefits from massive political support and ultra-favourable taxation reserved for locally produced models.

Tesla came second with 29,955 sales. June was a historic month for the brand, with more than 7,200 units sold in a single month. The American brand benefited from the shortcomings of the Turkish tax system. If an EV has a power output of more than 160 kW, it is taxed heavily (40-60%). Tesla has therefore limited its vehicles to this limit to enable Turks to buy without breaking the bank.

BYD completes the podium with 17,639 units sold. A latecomer to the Turkish market at the end of 2023, the Chinese giant has methodically rolled out a range of nine models covering all segments. In 2025, BYD announced a billion-dollar investment to build a production plant in Manisa, capable of producing 150,000 vehicles a year by the end of 2026. This strategic move will enable the Chinese company to get round the 40% import tariff.

A fast-expanding recharging network

The explosion in sales is logically pushing the country to speed up the roll-out of its infrastructure. And the figures show an accelerated catch-up, even if the coverage remains very uneven.

In June 2025, Turkey had 31,433 public charging points, according to the Energy Market Regulatory Authority (EPDK), compared with just 6,500 in March 2023. This growth of more than 370% in two years reflects a real effort, albeit from a very low base. By autumn 2025, the network will have more than 37,000 outlets, concentrated in Istanbul (more than 3,000 stations), Ankara (1,322 stations) and Izmir.

Turkey’s infrastructure is structured around several major operators:

ZES dominates the market with a national network covering motorways and urban centres.

Trugo, Togg’s proprietary network, now has more than 1,000 ultra-fast DC chargers and 600 AC stations spread across the country’s 81 provinces.

Eşarj, operated by Enerjisa, offers a multi-brand network accessible via mobile application.

The problem in Turkey is that beyond the metropolises, things are more complicated. Indeed, rural areas remain largely under-equipped. Government targets are ambitious: 143,000 plugs by 2030 and 273,000 by 2035 to support an estimated 1.5 million electric vehicles. To achieve this, however, between €500 and €600 million will have to be invested.

ÖTV tax

This success does not come from nowhere. If Turkey is experiencing such an explosion in electric vehicle sales, it is above all thanks to an ultra-aggressive tax policy that makes electric vehicles the most economically rational option.

At the heart of the system is the special consumption tax (ÖTV), which applies to all new vehicles according to a scale based on power, price and origin of the vehicle. For internal combustion vehicles, this tax varies between 80% and 220% of the base price, making the purchase of a petrol or diesel car extremely expensive for the average consumer.

By contrast, electric vehicles benefit from spectacular tax reductions: 10% for models with less than 160 kW and a base price of less than 1.65 million Turkish lira (around €47,000), and up to 60% above these thresholds. Even in the most unfavourable case, an electric vehicle is still more attractive from a tax point of view than its internal combustion equivalent.

As a further government incentive, the system includes an incentive for local production: electric vehicles assembled in Turkey, such as Togg, benefit from additional tax advantages, including corporate tax deductions for the companies that buy them. This mechanism is clearly designed to favour Togg over imports.

The scheme had an immediate effect on purchasing behaviour. In June 2025, just before the tax thresholds were adjusted, sales of electric vehicles soared by 233.6% year-on-year, as buyers rushed to take advantage of the lowest rates before they were revised. Tesla, with its Model Y limited to 160 kW, made the most of this window of opportunity.

But this tax policy raises questions. By creating a massive tax advantage for Togg, the Turkish government is distorting competition and potentially discouraging other international manufacturers from investing in the country.

Ambitious targets for 2030

The Turkish government is making no secret of its ambitions. The national plan aims to have 2.5 million electric vehicles on the road by 2030, 35% of them locally produced. This target rises to 10 million vehicles by 2040, with a 100% electric fleet by 2053 to achieve carbon neutrality.

To achieve this, the government is mobilising several levers: subsidies for R&D, support for battery factories, development of the recharging network via public-private partnerships, and maintaining a tax system that favours locally produced electric vehicles.

But these objectives presuppose economic stability and a sustained growth trajectory, which the country is struggling to guarantee. High inflation, the volatility of the Turkish lira and regional geopolitical tensions are all uncertainties that could slow or compromise these ambitions.

A structuring local ecosystem

The country is gradually developing a local industrial ecosystem around electromobility.

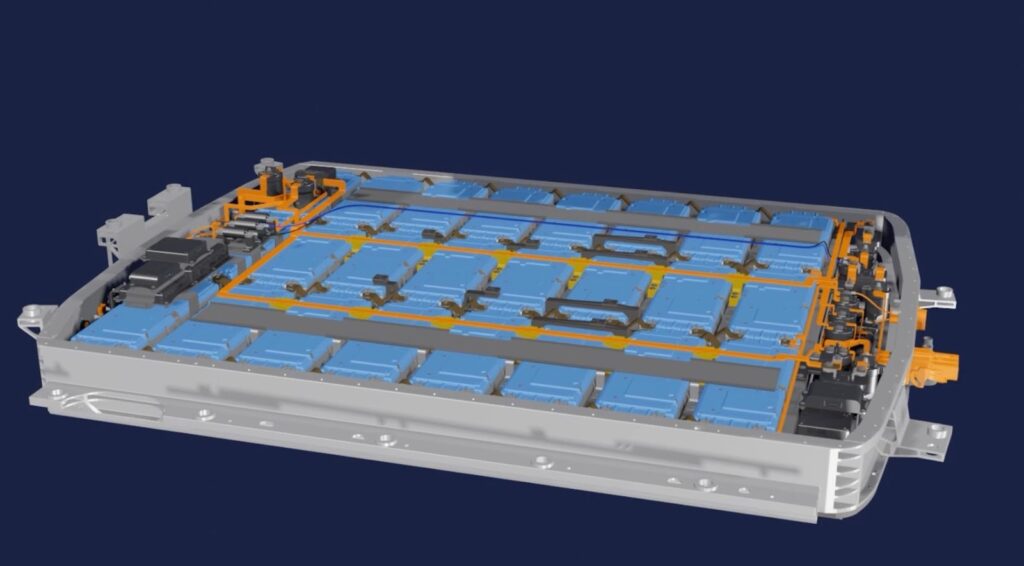

SIRO produces batteries for Togg vehicles at its Gemlik plant. With a current capacity of 3 GWh per year, the plant aims to reach 20 GWh by 2031, enough to equip several hundred thousand vehicles.

Aspilsan produces around 22 million battery cells a year, mainly in nickel-metal-hydride and lithium-ion technologies. Historically focused on the defence and energy sectors, the company is now turning its attention to the automotive industry.

In 2025, three new battery plants came on stream: Ottomotive (5 GWh of battery packs), Reap Battery (5 GWh for energy storage) and Maxxen (10 GWh). These combined capacities of 20 GWh position Turkey as a potential regional hub for battery production.

Finally, the electric vehicle components and equipment industry is showing impressive growth: exports of spare parts for EVs reached more than €1 billion in June 2025, up 13% year-on-year.

Structural barriers to mass adoption

Despite the spectacular growth in sales, a number of obstacles remain that could slow the momentum in the medium term.

Customs tariffs, set at 40% on electric vehicles imported from China, heavily penalise buyers and limit access to the most affordable Chinese models. This protectionist measure aims to encourage local production, but it also reduces competition and keeps prices high for a large proportion of the population.

In Turkey, there are no CO₂ standards. This leaves the combustion market to flourish without regulatory pressure. Unlike the European Union, where emissions quotas force manufacturers to electrify their ranges, Turkey imposes no climate constraints on new vehicle sales.

The electricity grid is a growing concern. With a heavy reliance on imported natural gas and limited domestic renewable generation capacity, the country could face stresses on the grid if the electric vehicle fleet reaches its target of 2.5 million units by 2030.

Rural infrastructure remains largely inadequate. While the major cities account for the bulk of charging points, the rest of the country is struggling to keep up. The lack of a complete motorway network is holding back adoption for inter-city journeys.

As everywhere else, price is still an adoption issue. Even with tax benefits, an electric vehicle remains a considerable investment in a country where purchasing power is under pressure.

A European surprise, but still fragile

Turkey is emerging as one of the major surprises on the world electromobility scene. In the space of just three years, the country has gone from an anecdotal market to a player that rivals European nations.

This acceleration is largely based on a tax policy that massively favours local production to the detriment of international competition. While this strategy has made it possible to structure a national industry, it has also made the market extremely dependent on the State’s tax choices. Any downward revision of ÖTV benefits could brutally break the momentum.

Turkey is developing its electromobility, and fast. As a bridge between Europe and Asia, Turkey is ambitious. Let’s see if this transition will last over time.