In just a few years, Brazil has gone from being a niche market to the driving force behind electromobility in Latin America. Buoyed by an explosion in sales of electrified vehicles, an aggressive industrial policy and the massive arrival of Chinese players, the country is speeding up its transition, even though combustion engines remain ultra-dominant and a number of structural obstacles persist.

A fleet that is electrifying at high speed

The Brazilian dynamic can only really be seen if you look at the figures for the last few years. In 2020, electric vehicles were still anecdotal in a market dominated by internal combustion engines. Four years on, the landscape has changed radically.

According to ABVE and various market analyses, sales of plug-in vehicles (100% electric and plug-in hybrids) will rise from around 19,300 units in 2023 to 61,600 in 2024, an increase of more than 200% in one year.

If we extend this to all electrified vehicles, market studies estimate that the total exceeds 150,000 units over the year, and this trend is set to continue in 2025. The market share of electrified vehicles reached around 4% of new registrations in the January-November total, in a global market of around 2.5 to 2.7 million vehicles.

Some months in 2025 broke records, with more than 24,000 electrified vehicles (BEV + PHEV + HEV) sold in a single month. This is a clear sign that electric vehicles are becoming more widespread in Brazil, even if combustion engines remain the dominant mode.

BYD, GWM and the others: a market dominated by the Chinese

If there is one striking feature of Brazilian electromobility, it is the central role played by Chinese brands, far ahead of the traditional manufacturers.

The figures speak for themselves:

- In 2024, BYD and GWM (Great Wall Motor) will together account for 81.6% of plug-in electric vehicle sales (BEV + PHEV) in Brazil.

- BYD alone has around 70% of the BEV market and more than 50% of the PHEV market, confirming its almost hegemonic domination of trendy models.

- In May 2025, BEV sales reached a monthly record: BYD accounted for more than 80% of all 100% electric registrations, well ahead of Volvo and GWM.

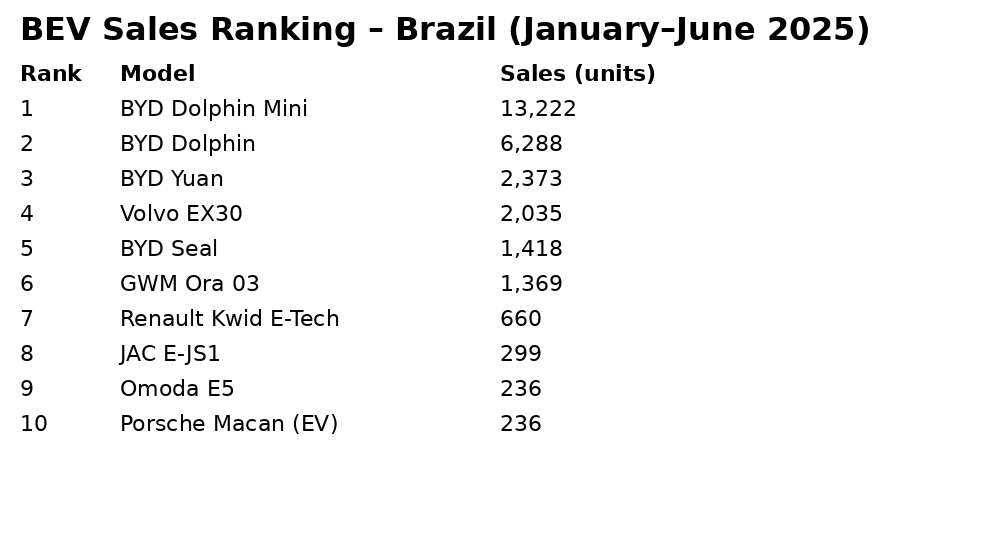

As this table shows, Chinese manufacturers dominate the ranking of the best-selling 100% electric vehicles in Brazil, although Volvo does manage to stand out:

A recharging network that’s catching up fast

To continue the development and democratisation of EVs, the development of recharging infrastructure is vital. Although it has a long way to go, the charging system for electrified vehicles in Brazil is keeping pace with the adoption of these vehicles.

In 2019, Brazil had just a few hundred public chargepoints; today, the country has a network that, while not yet homogeneous, is beginning to cover its main axes. In fact, an analysis of the growth of the infrastructure shows that by summer 2025, there will be almost 17,000 charge points with general or restricted access, covering more than 1,500 municipalities, demonstrating the gradual extension of the infrastructure beyond just the state capitals.

The figures reveal a clear trend: the Brazilian network is expanding rapidly, particularly on the major motorways linking São Paulo, Rio de Janeiro, Belo Horizonte, Curitiba and the south of the country. But also in dense urban areas where the first adopters and professional fleets (VTC, delivery, services) are concentrated.

Industry projections estimate that at least 150,000 charging points will be needed by 2035 to support a fleet of around 3 million electric vehicles, which means a sustained rate of investment over the coming decade.

A proactive industrial policy: MOVER and taxation

Obviously, as in every country with a clear desire to make progress in terms of electromobility, the government has put in place measures and aid to support and help this change.

One of the major turning points in Brazilian electromobility is the entry into force of the MOVER programme (National Programme for Green Mobility and Innovation). Launched in 2024 as part of the Lula government’s industrial policy, this programme aims to modernise the automotive sector around climate and innovation criteria.

- MOVER introduces a bonus-malus system on the IPI (tax on industrialised products), which favours low-emission vehicles and penalises the most polluting models.

- It provides direct financial incentives to reduce the purchase price of electrified vehicles.

- It provides for around 19.3 billion reals (nearly 4 billion euros) in incentives for innovation between 2024 and 2028, focusing on R&D, electrification, energy efficiency and the use of recycled materials.

- The programme also imposes improved carbon accounting throughout the vehicle life cycle, with increasing requirements in terms of recyclability and recycled content.

As a result, manufacturers from around the world have announced investments of more than €23 billion in Brazil over the next few years, including several projects directly linked to electromobility.

On the trade front, customs policy has been tightened to regulate imports and encourage domestic production:

- After a period of reduced import duties to launch the market, the government has decided to gradually raise tariffs on imported electric vehicles (BEVs, PHEVs, HEVs) to converge towards the 35% ceiling, which is the maximum rate authorised by the rules of MERCOSUR (the South American Common Market).

- This trajectory is clearly intended to encourage manufacturers, particularly BYD and GWM, to locate part of their production in Brazil in order to maintain their price competitiveness.

And the result of all these efforts to promote Made in Brazil is hard-hitting and effective. BYD plans to transform the former Ford plant at Camaçari (Bahia) into a production hub for electric vehicles and batteries, while GWM is investing in the local assembly of hybrid and electric models in the state of São Paulo. Volkswagen and Stellantis have also announced packages dedicated to the gradual electrification of their locally produced ranges.

WEG, Tupi Mob and a structuring local ecosystem

While the majority of electric vehicles sold in Brazil still come from China, national players are emerging in the field of recharging infrastructure and services.

The most emblematic case is that of WEG, an industrial giant from the state of Santa Catarina. Historically renowned for its electric motors and industrial automation systems, WEG has gradually extended its expertise to electromobility, developing a comprehensive range of recharging solutions: home chargers, public DC charging points and energy management tools.

In October 2025, WEG announced the acquisition of 54% of Tupinambá Energia (Tupi Mob), which operates one of the country’s leading recharging platforms. The Brazilian group is now not only an equipment supplier, but also and above all a player in the recharging ecosystem.

Thanks to this acquisition, WEG now combines hardware, software and network or fleet management services, a positioning that is still rare in Brazil. The group intends to play a leading role in the energy transition in the transport sector.

Other players are developing around this hub:

- Energy companies such as Raízen are committed to the deployment of electric fleets, with a partnership aimed at integrating 20,000 electric vehicles into the fleet of VTC 99 by the end of 2025.

- Private operators, property developers and infrastructure managers are developing networks of charging points in car parks, shopping centres and service stations, capitalising on the massive arrival of Chinese models and the growing interest of business fleets.

Persistent obstacles to mass adoption

Despite this momentum, Brazil is still a long way from achieving majority electromobility. And for good reason: there are a number of obstacles to scale-up.

- Still high purchase price: even if Chinese models are driving prices down, the gap with a combustion vehicle remains significant for a large proportion of the population, especially in a very sensitive market.

- Interest rates and purchasing power: car financing relies heavily on credit. High interest rates and under-pressure purchasing power make it more difficult to buy recent vehicles, especially electric ones.

- Uneven infrastructure: the major cities are benefiting from a growing density of charging points, but a large part of the country remains poorly equipped, fuelling « autonomy anxiety » for inter-city journeys and business use outside the main roads.

- Electricity grid and reliability: even though Brazil’s electricity mix is largely decarbonised thanks to hydroelectricity, some regions suffer from grid capacity and reliability constraints, making it difficult to roll out fast charging on a large scale.

A large region in transition, but still breaking in

Brazil is proving to be one of the most interesting laboratories for electromobility in the world, with an assertive industrial policy, a mass market, the importance of flex-fuel (ethanol), a Chinese offensive and the emergence of local players in recharging. The figures show a real and palpable take-off, but the market share is still modest in terms of the national fleet.

Brazil has laid the foundations to become a regional pillar of electric mobility. All that remains now is to build on this success: accelerate the reduction in costs, increase the density of the network of charging points outside the major cities and remove the cultural and financial obstacles that still stand in the way of truly mass-market electromobility.