France is banking on electric vehicles to secure its industrial and environmental future. In 2024, production of electric vehicles jumped by 68%, driven by iconic models such as the Renault 5 electric and the Peugeot e-3008. But in a market dominated by China and the United States, the French industry must redouble its efforts to remain competitive. Between innovation, relocation and economic pressure, the French electric vehicle industry is at a turning point.

The French government has set an ambitious target of 800,000 electric vehicle sales per year by 2027, up from around 300,000 in 2023. This will be accompanied by accelerated development of charging infrastructure, with a target of 400,000 charging points installed by 2030. To encourage consumers to take the plunge, schemes such as the ecological bonus and social leasing at 100 euros a month have been introduced. However, these incentives are gradually being reduced, a sign that the market needs to become more self-sufficient.

At the same time, French carmakers are investing massively to offer vehicles that are more efficient, more autonomous and more accessible to a wider customer base. However, there are still many challenges to be overcome, such as the still high purchase price, the cost of batteries, uncertainties over critical materials, and the resistance of some consumers to new powertrains.

Strategic investment for greater autonomy

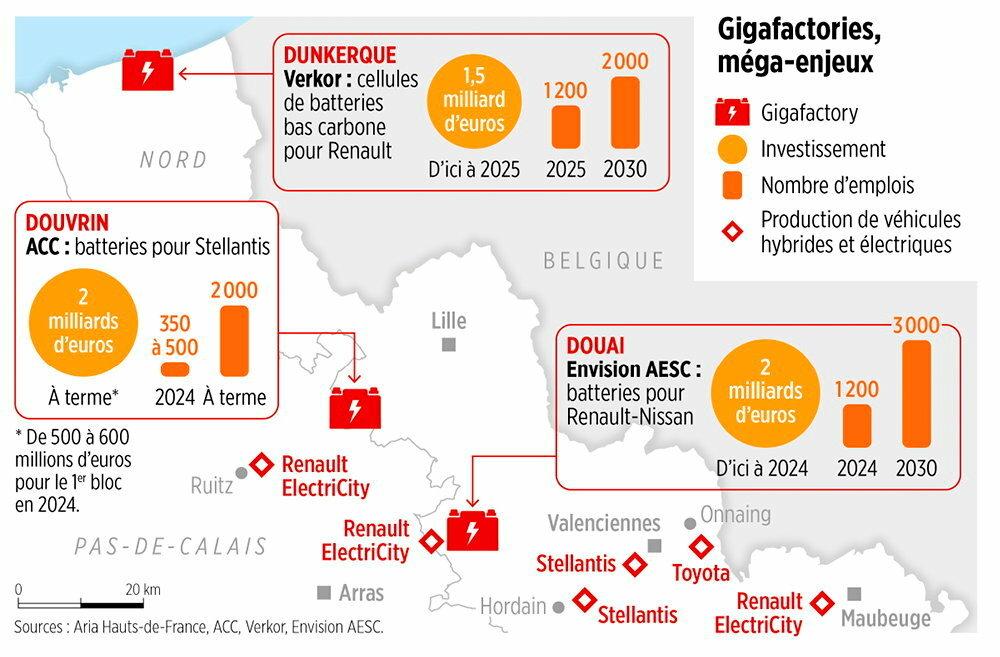

Faced with Europe’s dependence on Asian imports of batteries and rare materials, France has embarked on a policy of industrial sovereignty. Several gigafactories are currently under construction, notably in the north of the country, with the aim of producing batteries locally and reducing logistical and environmental costs. In Dunkirk, a Franco-Chinese partnership between Orano (formerly Areva) and XTC New Energy Materials, announced in December 2024, plans to manufacture battery components. This €1.5 billion ambition, conceived as part of the NEOMAT project, raises both hopes and questions about technological dependence on China.

Raw materials are also a major issue. The energy transition depends to a large extent on rare metals such as lithium, cobalt and nickel, the extraction of which is highly concentrated in a few countries, particularly in South America and Africa. To secure these resources, France and Europe are seeking to diversify their supplies and invest in projects to recycle used batteries.

Fierce international competition

While electromobility in France is making progress, it faces intense competition. Tesla, with its plant in Berlin, is flooding the European market and dominating sales with its Model Y, which has become the benchmark electric SUV thanks to its range, performance and ultra-developed recharging network. This local presence enables Elon Musk’s brand to avoid customs duties and speed up deliveries in Europe, strengthening its dominant position.

China, meanwhile, despite French restrictions on aid for vehicles produced outside Europe, is making its mark with brands such as BYD and MG Motors. These manufacturers are banking on very competitive prices and advanced technologies, particularly in terms of batteries and energy efficiency. BYD, which develops its own lithium-iron-phosphate (LFP) batteries, enjoys a strategic advantage by reducing its production costs and offering high-performance models at attractive prices. Blade Battery technology currently offers capacities of 61.44 kWh and 80.64 kWh, giving a range of between 433 and 552 kilometres according to the European WLTP homologation cycle. Chinese-controlled MG Motors is also attracting interest with its well-equipped, affordable vehicles, increasing the pressure on European manufacturers who are struggling to compete in the entry and mid-range segment.

The French industry is seeking to distinguish itself through the quality of its vehicles and their integration into a national energy ecosystem. The government is supporting this approach through the France 2030 plan, which aims to produce two million electric vehicles a year in France by 2030, by mastering cutting-edge technologies such as electric motors and batteries. Producing more affordable vehicles is one of the major challenges. Several projects aim to develop models costing less than €20,000, while guaranteeing satisfactory range and durability. For example, Renault plans to market an electric version of the Twingo in 2026 at a price of less than €20,000.

A key role for public policy

To support the industry while speeding up the ecological transition, subsidies for the purchase of electric vehicles will be gradually reduced, from €1.5 billion to €1 billion by 2025. At the same time, stricter taxes on internal combustion vehicles are being introduced to encourage consumers to switch to electric vehicles.

France is investing in battery recycling to limit its environmental impact and reduce its dependence on imports of rare metals. Companies such as Verkor and Northvolt are developing innovative solutions to recover lithium, cobalt and nickel, reintegrating these materials into new batteries.

By focusing on the circular economy, the aim is to secure supply, reduce the carbon footprint and strengthen industrial autonomy. These initiatives are part of a wider strategy to make electric mobility more sustainable and competitive.

Making the transition more accessible

The development of electromobility in France must not be at the expense of accessibility for low-income households. Developing a range of low-cost vehicles and extending the recharging network, including in rural areas, are priorities. Electric vehicles must also be integrated into a broader framework of sustainable mobility, including car-sharing and improved public transport.

Another major challenge lies in training professionals and adapting infrastructures. The installation of charging points needs to be accelerated in condominiums and public spaces, while garages and technicians need to be trained in the specific features of electric vehicles to support their widespread deployment.

The next few years will be crucial in determining whether France succeeds in establishing itself as a major player in electric vehicles in Europe. With strategic investment, an ambitious industrial policy and a focus on consumer needs, the French automotive industry has a card to play in this global transition.