On 16 January 2026, Ottawa announced the partial lifting of surtaxes on Chinese electric vehicles (EVs) and opened up an annual quota of 49,000 units at the « normal » tariff of 6.1%. In return, China drastically reduced its customs duties on Canadian canola (a variety of rapeseed highly prized in China), reopening a market estimated to be worth several billion dollars.

What the Canada-China agreement provides for

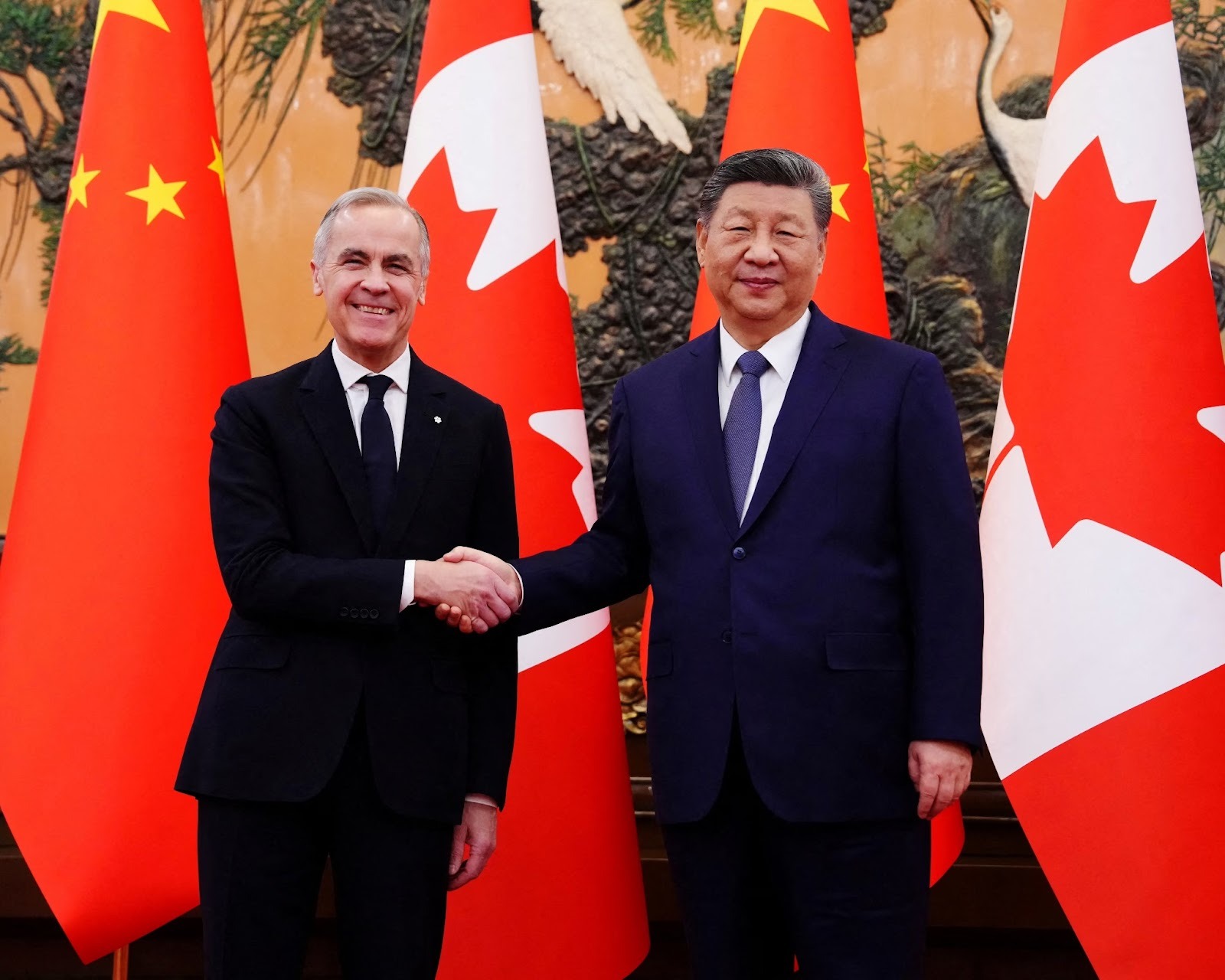

To understand the situation before this agreement, we need to go back to 2024, when the Canadian government imposed a 100% surtax on all EVs imported from China, following the hard line taken by the US and almost completely closing off the market. The new agreement, reached during Mark Carney’s visit to Beijing for the first time since 2017, now introduces an annual quota of around 49,000 vehicles with customs duty reduced to 6.1%, the most-favoured-nation rate.

And this quota is evolving, as Ottawa is forecasting an increase to around 70,000 units per year over the next five years, according to the specialist media and official announcements.

The agricultural counterpart: canola

As a mirror image of this tax cut, Beijing is also reducing its customs duties on Canadian canola, from a cumulative level of around 84% to a target of close to 15% from 1 March 2026. This measure puts an end to a trade dispute that began after the Canadian surtaxes, and which led China to use canola as an instrument of economic pressure.

Western provincial governments are hailing the agreement as a breath of fresh air for farmers. Particularly in Saskatchewan, the country’s leading canola producer, where farmers are heavily dependent on the Chinese market to sell their crops.

Expected impact on the price of EVs in Canada

The Canadian government plans that, by 2030, at least half of China’s electric vehicle quota should be devoted to « affordable » models, with an import price of less than or equal to CAD 35,000 (≈ €22,000). A real challenge, to be sure, but one that could significantly reduce the entry ticket to electric in a market where even an entry-level Nissan Leaf remains around CAD 44,000 (≈ €28,000) before government subsidies.

This new tax could enable new Chinese manufacturers to expand into Canada with competitive Chinese models from the likes of BYD, Geely, Nio and Xpeng, with some vehicles potentially on offer for under CAD 30,000 (≈ €19,000) once transport costs and margins have been factored in.

Specific features for Quebec

To put this quota into perspective, if a significant proportion of these 49,000 vehicles arrived in Quebec, they would represent almost half of the 103,000 electric vehicles sold in the province in 2024. In this context, the arrival of cheaper Chinese models could partially offset the end of subsidies under the « Go Green » programme.

For local players such as installers, specialist outlets and advisers, for example, this opening represents both an opportunity for democratisation and an educational challenge in terms of the reliability, maintenance and residual value of brands that are still little known.

A clear break with American strategy

While Washington maintains 100% tariffs on Chinese EVs, Canada is taking a pragmatic approach, focusing on its economic interests. Mark Carney insists on Canada’s « specificity » and the priority given to the national economy, even if this position contrasts with that of the United States.

This strategy could make Canada a North American gateway for Chinese EVs and reshuffle the cards in continental value chains. Indeed, this agreement seems to produce potential winners and losers:

- The winners are consumers, with more affordable EVs, and canola growers, who gain privileged access to the Chinese market.

- Potential losers: traditional North American manufacturers such as GM and Ford, for example, who will be exposed to highly competitive Chinese competition, and the unions, which are worried about jobs, despite promises of local investment and industrial partnerships.

More than just the outright sale of EVs, this agreement could be the gateway to a partial overhaul of part of Canada’s transport economy. Under the agreement, the arrival of these EVs will serve as a lever to attract assembly plants and investment in the value chain (batteries, components, R&D), in order to stimulate the Canadian industrial ecosystem.

Technical consequences and infrastructure

The Chinese are keen to appeal to as many markets as possible around the world, and have developed their vehicles accordingly. Indeed, the EVs exported are adapted to the North American CCS standard, limiting incompatibilities. Nevertheless, installers will have to familiarise themselves with different electronic and software architectures, particularly for charge management and OTA updates.

The arrival of these vehicles could accelerate the densification and modernisation of the charging network, particularly rapid charging, if Chinese players participate in the roll-out of infrastructure.

Geopolitical and transition issues

The Mark Carney-Xi Jinping agreement illustrates a strategic repositioning of Canada: Ottawa is favouring economic pragmatism (affordable EVs + canola) over systematic alignment with Washington.

The bet is that accelerating the adoption of EVs will partially offset the risks associated with job losses in the traditional car industry and position Canada as a North American hub for electromobility.

The key question remains: will these Chinese EVs be able to win over a market accustomed to North American standards, and will this historic turning point generate more benefits than economic and political tensions?