The auto industry as we know it is a relatively young one. With around 120 years old, it has remained the same over the last 50 years with the American, European, and later the Japanese and Korean makers expanding it globally.

However, during the last 5 years, this status quo has been dramatically changed. The rise of China to become the world’s second-largest economy is also having a big impact in the automotive industry. For 30 years, they worked together with the Western firms and learnt from them. Today, many of them have matched their foreign partners. The student beat the teacher.

Chinese car brands booming

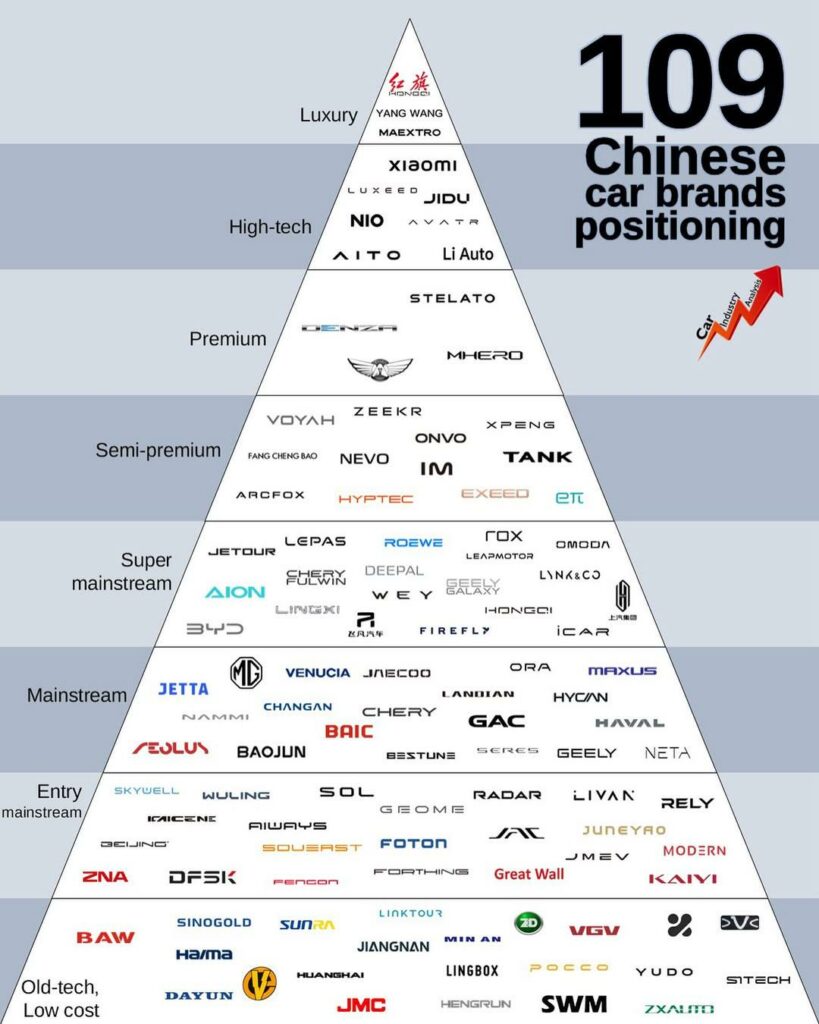

As of October 2025, there are more than 100 passenger car brands from China. That’s more than the total combined brands from Europe (57), USA (14), Japan (14), Korea (4). With more than 24 million units sold last year, China is a huge market where many brands can play. But they are not all the same.

The old-tech or low-cost brands are those whose vehicles feature old platforms, usually from old models from Western brands. They target the entry-level segments with very low prices, mainly for tier 3 cities and the countryside. They include brands for China only like Hengrun, Pocco, Vi Auto, and some others available outside China like SWM, ZX Auto, JMC, and BAW.

The mainstream brands that I split in three groups: entry, mainstream, and super. This is where most of the brands are positioned considering the average income of the consumers in China. They start with brands like JAC (276 units registered in Europe in Jan-Aug/25), Forthing (2,360 units), and many others. Then there are the mainstream ones like BAIC (3,379 units), Chery (410 units), Jaecoo (26,600 units), MG (196,324 units, or 2.3% market share), or Geely (1,388 units). The upper-mainstream brands include some like Jetour, Omoda (27,726 units), Lynk & Co (6,216 units), and BYD, which has registered 95,346 units in Europe in Jan-Aug 2025, or 1.1% market share.

Then there are the semi-premium brands like Voyah (378 units), Zeekr (2,569 units), and Xpeng (10,913 units). The premium ones include Denza, Stelato, MHero, and Yuanhang.

They are out-positioned by the High-tech brands or the fast-growing EV start-ups: Xiaomi, Luxeed, Nio, Avatr, Aito, Li Auto. From them, only Nio is available in Europe, where it has registered 593 units since January.

And finally, there are the luxury brands, which at the moment are composed of only three brands: the Golden Sunflower subbrand from Hongqi, BYD’s Yang Wang, and JAC’s Maextro. Plenty of choices for a massive market and an aggressive global expansion plan.