The project promised to revolutionise regional aviation with a Franco-French hybrid aircraft.Today, VoltAero, founded by Jean Botti, is fighting for survival. Placed under judicial reorganisation on 7 October, it urgently needs €2 million to avoid collapse. Between unfulfilled promises, absent investors, and the sudden withdrawal of its industrial partner ACI, the pioneer of low-carbon aviation faces its most critical hours.

A rising star of French aerospace in peril

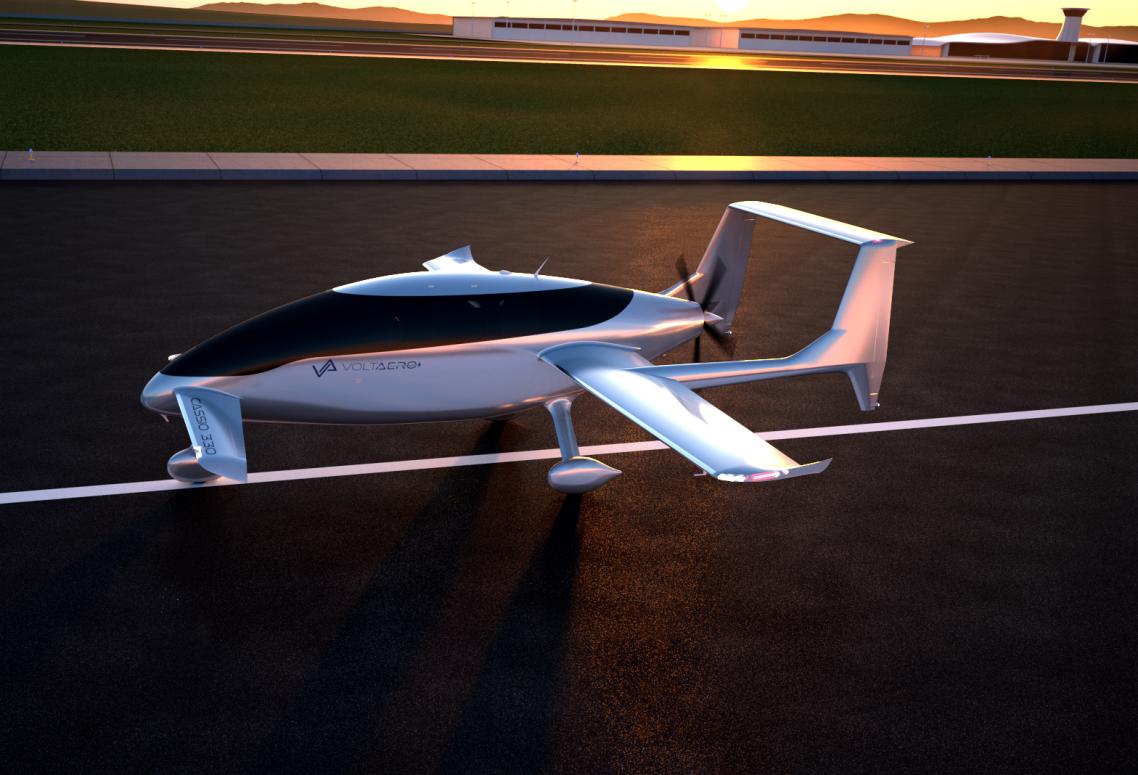

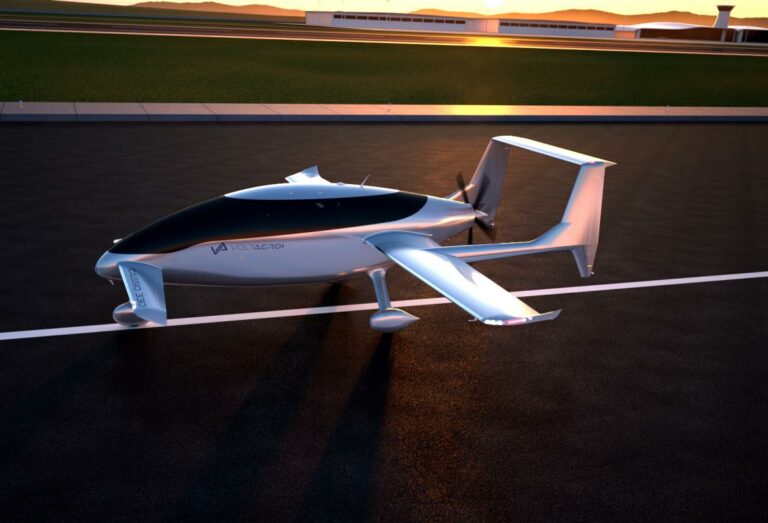

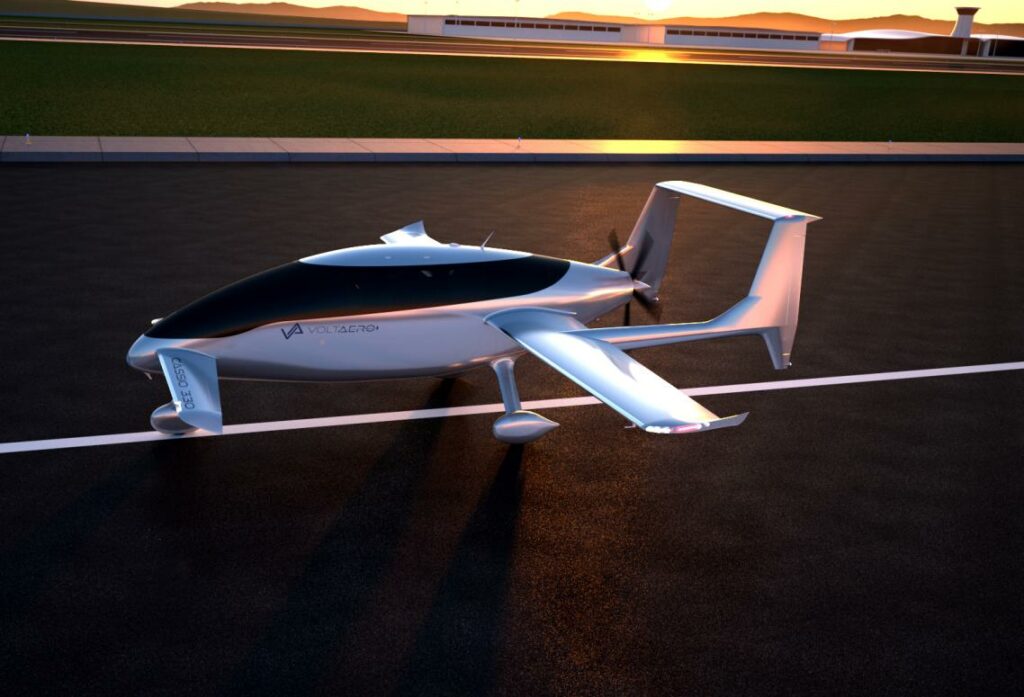

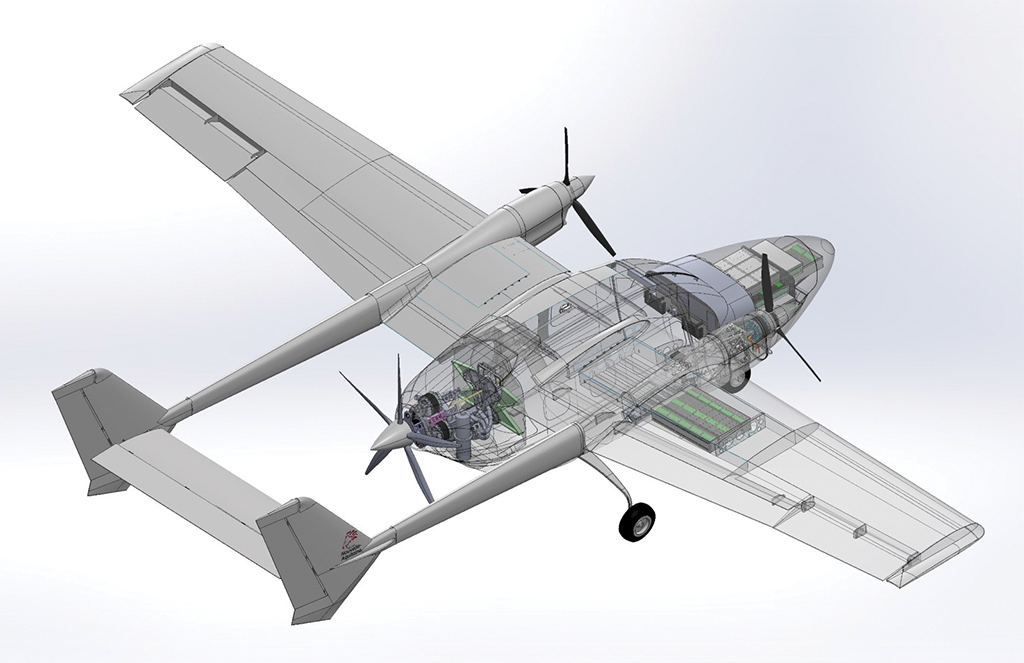

Founded in 2017 in Rochefort, VoltAero had everything to represent the future of light hybrid aviation. Its Cassio 330, a five-seater combining electric and conventional engines, was set to be the first series-produced aircraft in France. The company inaugurated its brand-new assembly plant in November 2024, aiming to produce up to 150 aircraft per year from 2026. The order book was already full, with over 250 pre-orders. Yet, the start-up suddenly faced insolvency at the end of September after ACI Groupe, its main industrial investor, went into judicial reorganisation.

ACI’s withdrawal, a shockwave

At the Paris Air Show in June, VoltAero and ACI Groupe announced a strategic partnership and ACI’s upcoming 10% stake in the capital. This €10 million investment was supposed to secure the start-up’s cash flow. But three months later, ACI itself went into administration, freezing all commitments. “The capital entry was supposed to be finalised at the end of the month, which would have ensured business continuity,” regrets Jean Botti. This reversal triggered a domino effect, plunging VoltAero into crisis. “We are collateral victims of an absurd situation,” the founder said.

Safran, a partner but not a saviour

To stay afloat, VoltAero turned to its partner Safran, whose engines equip its planes. However, the aerospace giant refused to invest. On BFM Business, CEO Olivier Andriès expressed being “touched” by the situation but stressed that Safran is “not an investor but an industrial partner.” This stance left Jean Botti frustrated. “We helped Safran develop its electric engine in 2021,” he emphasised, highlighting a lack of solidarity in French industry.

Public support, but a private gap

Despite private investors’ caution, VoltAero has benefited from public backing. The French government invested €5.6 million via the France 2030 plan, and the Nouvelle-Aquitaine region provided over €10 million, half in grants. These funds financed research and industrialisation of the Cassio 330. Yet they cannot fill the cash gap left by ACI’s withdrawal. Jean Botti points to a broader issue: “In France, private investors prefer AI, which requires less capital and offers quicker returns.”

A plane ready to fly, a technology already proven

The Cassio 330 is not a concept. It has been flying since 2020 and has logged over 25,000 kilometres in tests. Its hybrid technology is patented, and early results impressed the public at the Paris Air Show. VoltAero also planned assembly lines in Malaysia and the United States. The American distributor Altisky was to sell the Cassio, manage after-sales, and help build a facility in Tennessee. In parallel, an agreement with Malaysia’s SEDC Energy provided for a second Asian production site.

One month to avoid a crash

Today, the founder is racing against time. The judicial reorganisation opens a six-month observation period, but Jean Botti believes he has only a month to find a solution. Priority: convince SEDC Energy to increase its stake to compensate for ACI’s withdrawal. Other investors are being approached. “The designs are ready, the factory is ready. All we need is funding to start production,” he insists.

A symbolic battle for French industry

Beyond VoltAero, the entire French decarbonised aerospace sector is on edge. The company symbolised local innovation capable of competing internationally. Its failure would reflect an industry still dependent on large groups and financial arbitrage. “Some talk, some fly. I have a plane that flies,” declares Jean Botti, determined to save his project. VoltAero will present a recovery plan by the end of October. The outcome will determine whether French hybrid aviation can still take off or if its wings will break on the tarmac of industrial disengagement.